Best mortgage rate forecast: Expect volatility in 2024

Here’s one solid assumption for mortgage rates for 2024 – they’ll act like a yo-yo. Again.

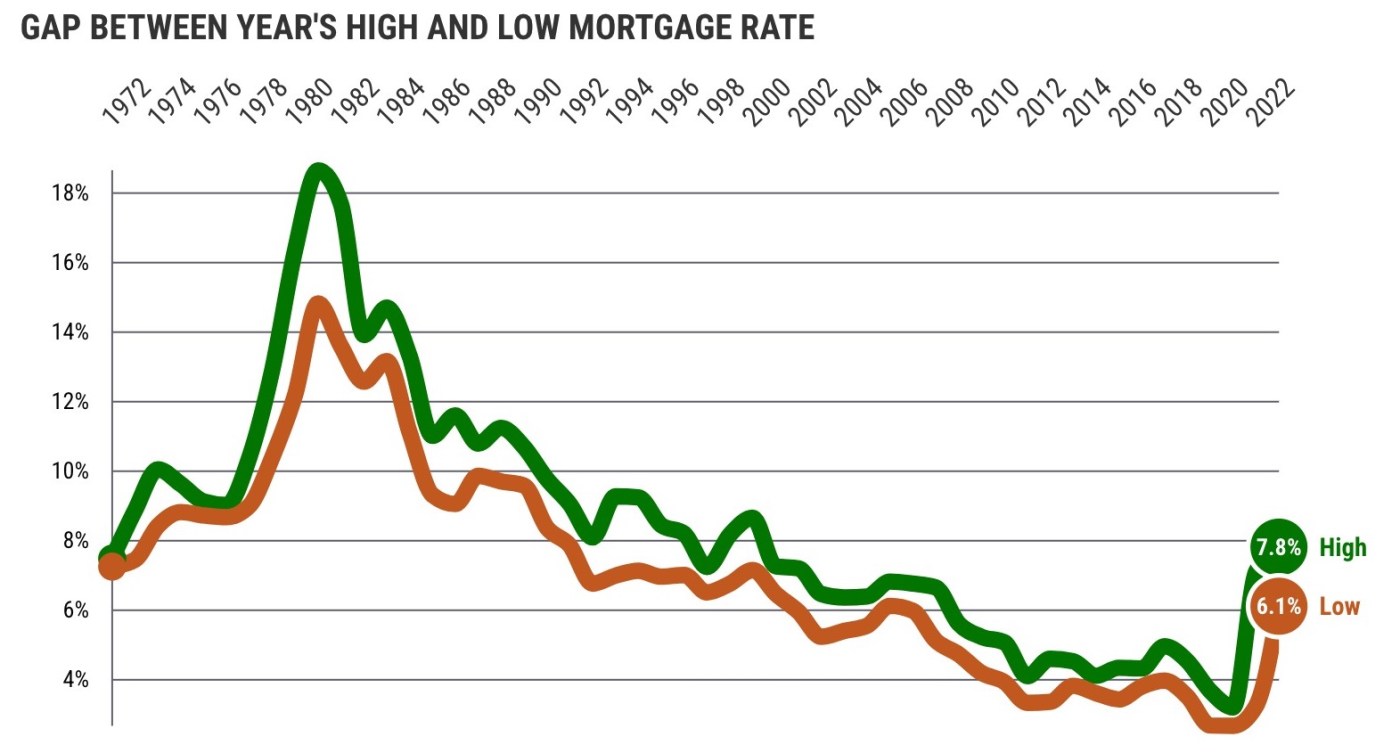

To see the extremes that home loans go through, my trusty spreadsheet looked at swings in Freddie Mac’s weekly 30-year average fixed rate going back to 1972.

And over the past half-century, the average year’s highest rate was 8.4% vs. a 7% low. That translates to a typical 12-month period having a 1.4 percentage-point swing between the top and bottom mortgage rate.

Yes, rate volatility is fairly normal.

Three odd years

But the size of rate gyrations during the past three years has not been normal.

Remember, the Fed aggressively used interest rates to first stimulate a coronavirus-chilled economy, only to then hike rates to fight an overheated business climate.

Well, 2023 was sort of mainstream with rates running from a 7.8% high to a 6.1% low. That’s a slightly above-average 1.7-point spread, top to bottom.

Still, this was the 11th widest gap in any year during the past half-century.

Yet those fluctuations look tame vs. 2022 when rates ranged from 7.1% to 3.2% as the Fed ended its cheap-money policy. That 3.9-point chasm was the third-largest rate swing in a half-century. Bigger swings were seen in 1980 and 1982, another period when rate hikes were used to battle inflation.

And somehow all this recent mortgage turmoil followed a far calmer 2021 when the Fed used cheap money to prop up the coronavirus-chilled economy.

Rates moved only between 3.2% and the record-low 2.65% in 2021 – a half-point spread that was history’s sixth-smallest gap.

Simply stated, history clearly shows mortgage rates rarely move in a straight line.

Make or break

Do not forget, the ups and downs of rates put huge spins on a borrower’s purchasing power. These fluctuations can make or break many a homebuying deal.

During the past half-century, there’s been an average 15% difference between the monthly mortgage payment tied to a year’s highest mortgage rate compared to the size of the monthly check at the lowest rate.

Last year, there was a 19% swing, history’s ninth-largest gap swing.

And that looks stable vs. a painful 2022 and the largest gyrations of the past half-century – a 55% difference due to the Fed increasing rates aggressively.

All that excitement came after a placid 2021 when purchasing power swung only 7%.

Still, history strongly suggests that mistiming the mortgage market can be an expensive mistake.

Bottom line

I took this rate-swing history and applied it to 2023’s year-end 6.6% average rate to create a forecast range for 2024.

Some simple math suggests the average 30-year mortgage rate will run between 7.3% and 5.9% in 2024. And that’s without doing much thinking about the Fed’s next moves, how the economy might fare, or what’s next for inflation.

By the way, history says a year’s average mortgage rate landed within this forecast formula’s projected range 80% of the time.

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at jlansner@scng.com

2024 economic forecasts

Chapman: ‘Very slow growth. No recession’

CS Fullerton: ‘Cracks’ will widen to a mild recession in late 2024

US Realtors: Housing rebound from 2023’s dismal sales

California Realtors: Rising prices, sales in 2024

USC: SoCal rents to rise 2-4% a year through 2025

Related Articles

Ticker: Applications for jobless benefits fall; Mortgage rate falls to lowest level since May

Ticker: Exploding toilet prompts lawsuit; Mortgage rates edge higher

2024 first-quarter housing trends: Rates begin to thaw

Bankrate: Should I pay off my mortgage or invest?

Warren: Feds need to step up as housing woes worsen