Pols & Politics: Winners and losers in Boston’s Great Tax Debate (hint: the truth)

Count your blessings, Boston taxpayers.

The Great Tax Debate of 2024 flamed out this past week in the state Senate after city assessors finally revealed the true property roulette math.

“Numbers matter,” Senate President pro tempore William Brownsberger of Boston said in dooming the city’s bill to push more of the tax burden on businesses.

“Now we know the sky isn’t falling,” Southie state Sen. Nick Collins added.

That was the big takeaway. Taxes hurt no matter where you open up that envelope. The rent is too damn high, and those who own residential property can’t afford to sell unless they plan to follow Bill Belichick to North Carolina. The commercial sector is also still climbing out of the pandemic.

Boston admitted (very late in the game) that “taxpayers are not looking at a 33% tax increase, but rather a 10% year-over-year increase,” Brownsberger said. (It’s 10.5%, to be exact).

But he’s right! Mayor Michelle Wu’s home-rule petition to hit the slumping commercial sector harder was based on tardy arithmetic. All the panic was unnecessary and it eroded her argument. But who’s to blame? Here’s our Pols & Politics scorecard (vote yourself here):

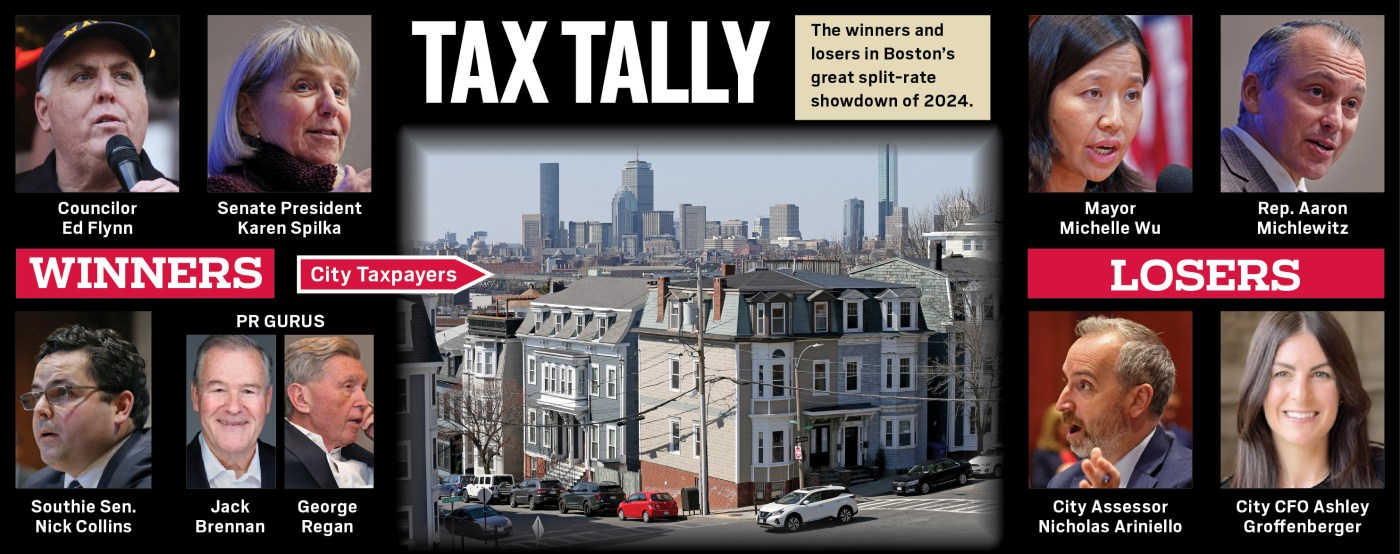

The Winners

City Taxpayers: The commercial sector still carries the load, but not at a crippling percentage. The City Council voted unanimously to set the residential tax rate at $11.58 per $1,000 of value and the commercial tax rate at $25.96 per $1,000 of value, with the maximum shift of the tax burden allowed by state law, or 175%, onto businesses. (Not the 200% or 190% and then 181.5% Wu wanted.) Homeowners who need help paying their tax bills do have options, and that is now part of the story, as it should be.

Councilor Ed Flynn: He was the lone dissenting vote from the get-go on the mayor’s tax gambit. It’s lonely when you’re 1 out of 13. But, he forced the mayor’s office to reveal the actual tax data. That’s a win for transparency.

Senate President Karen Spilka: She used her gavel to end the debate and spike the home-rule petition to “preserve the delicate balance of protecting the economic powerhouse that is Boston while addressing the very real concerns of property owners as we all face uncharted territory in a post-COVID Commonwealth.” All jobs point to Boston, in many ways in Massachusetts, and she understands that.

State Sen. Nick Collins: Like Flynn, he stood alone demanding city assessors come clean on the actual tax data. He’s been beaten up but stood his ground. Again, nobody likes taxes, but they do appreciate transparency. Collins helped shine some light on the cloudy estimates.

Jack Brennan & George Regan: These public relations pros dug in and fought back. The pandemic has changed the way we work. Hybrid office hours are bringing workers back to Boston, but at varying degrees. The city will recover. But will the politicians? …

The Losers

Mayor Michelle Wu: She fought for homeowners, yet did so as the City Hall budget grew by 8%. Some of that growth is locked into union contracts, but taxpayers need a show of support that doesn’t always demonize those who ask questions. And what about the ballooning cost of the White Stadium project? Now taxpayers must fork over $91 million? Pet projects and property taxes don’t always add up.

Rep. Aaron Michlewitz: The North End House Ways and Means chair was bitter about the bill he backed falling down, saying in part that Wu’s idea gave “the city the flexibility it needed to avoid double-digit residential tax increases.” But what about the confusion over the actual tax data? That doomed the bill and now hurts the very residential sector he was out to protect.

City Assessor Nicholas Ariniello: He failed to properly prep the City Council on the tax rates in enough time to end all doubt. The mayor’s press team screamed and yelled at the Herald over the fact that Ariniello tangled with the council at a tax classification hearing in early December. (He did, we observed.) Ariniello refused to provide Department of Revenue-certified data that would shed light on what next year’s tax rates would be. He said that an early release of the tax data would be “creating a situation for people to poke and create uncertainty.” When are facts bad?

City CFO Ashley Groffenberger: She has remained in the background and that’s unfortunate. As the Herald’s Joe Battenfeld pointed out this week, Groffenberger is Wu’s chief financial officer who presided over San Francisco’s out-of-control budget — which now faces 15% across-the-board cuts to deal with an estimated $1 billion deficit. Is Boston bound for the same fate?

Herald Poll: Rate winners and losers of Boston’s Great Tax Debate

The PILOT program

It hasn’t gone unnoticed that Boston’s PILOT program that appeals to tax-exempt institutions to pony up tax payments (or some in-kind programs) seems stuck in limbo. As the Herald reported, the Wu team is negotiating with nine of the biggest nonprofits in Boston to ink long-term volunteer PILOT payments to help ease the tax burden on homeowners and businesses.

Yet, the PILOT landing page on Boston.gov is stuck in last year’s results. Why no update? Where’s the transparency?

Taxpayers deserve to know now what the Harvards and hospitals have paid, or not paid. The year is almost over, yet the data is outdated. A spokesperson in the mayor’s press office said Friday the numbers will be refreshed “next year” and to send an email about it.

We will stay on this! Taxpayers deserve nothing less than total transparency.