Massachusetts collects $2.2B from ‘Millionaires Tax’ after roller coaster revenue year

Massachusetts’ voter-approved “millionaires tax” delivered roughly $2.2 billion last fiscal year, a massive haul that shot past original projections set by Gov. Maura Healey’s administration.

State budget writers said Friday the 4% surtax on incomes over $1 million managed to generate hundreds of millions more than expected during its first full year on the books. The additional money beyond the $1 billion lawmakers budgeted for fiscal year 2024 is slated to be transferred to a reserve account that can be tapped for future spending on education and transportation.

Administration and Finance Secretary Matthew Gorzkowicz said revenue officials projected in January 2023 that the state could collect up to $1.7 billion in revenue from the surtax but realized by April that the haul was going to be much bigger than originally anticipated.

Related Articles

Massachusetts likely to miss more revenue benchmarks this fiscal year, Healey’s budget writer says

Massachusetts collects $2.6B in July, about $18M less than same time last year

Massachusetts July tax collections expected to be ‘very bad,’ top budget writer says

Healey inks $57.8B budget

Pols & Politics: Republican John Deaton finds friends in the Winklevoss twins

The Healey administration cannot use the money collected under the surtax to balance the state’s budget, which had already experienced months of roller coaster revenues in fiscal year 2024.

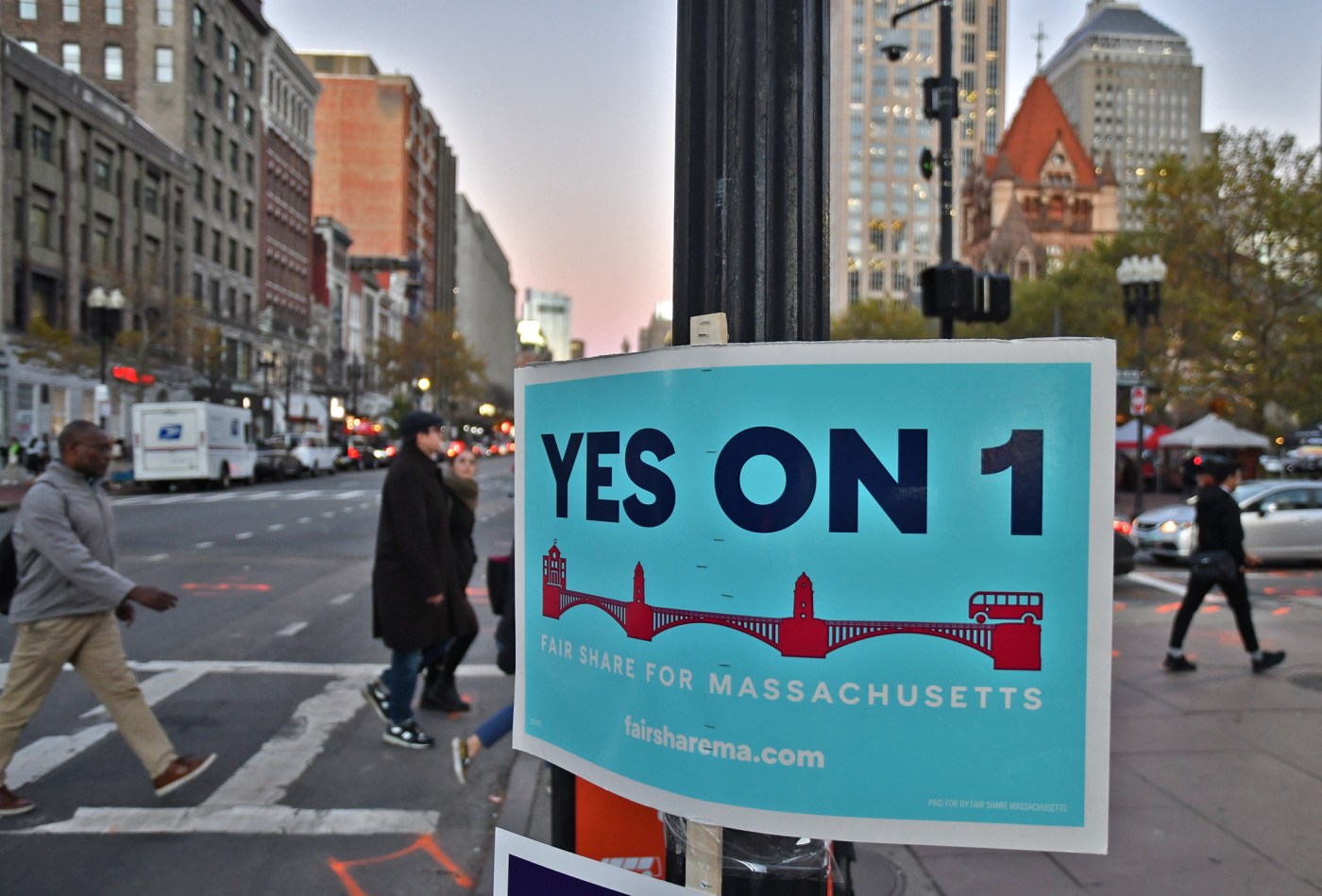

Voters approved the “millionaires tax” through a ballot question in 2022, which supporters argued was a “once-in-a-generation” opportunity to collect money for critical projects in the transportation and education sectors.

But opponents warned at the time that the surtax would push high earners out of the state and hurt small businesses.

Gorzkowicz said once the Healey administration removed the “millionaires tax” from the equation, Massachusetts ended fiscal year 2024 $233 million below revenue projections, which were lowered by $1 billion in January amid sagging collections.

But Gorzkowicz said the administration felt very comfortable that the state would close out the year in balance without drawing into Massachusetts’ multi-billion rainy day fund.

Taxes, he said, only account for 60% of the state’s total revenue haul for the year and officials are still working through the remaining 40% of revenue.

Healey is expected to file legislation closing the books on fiscal year 2024 around Labor Day, Gorzkowicz said.

This is a developing story…