Feds suspend ACA marketplace access to companies accused of falsely promising ‘cash cards’

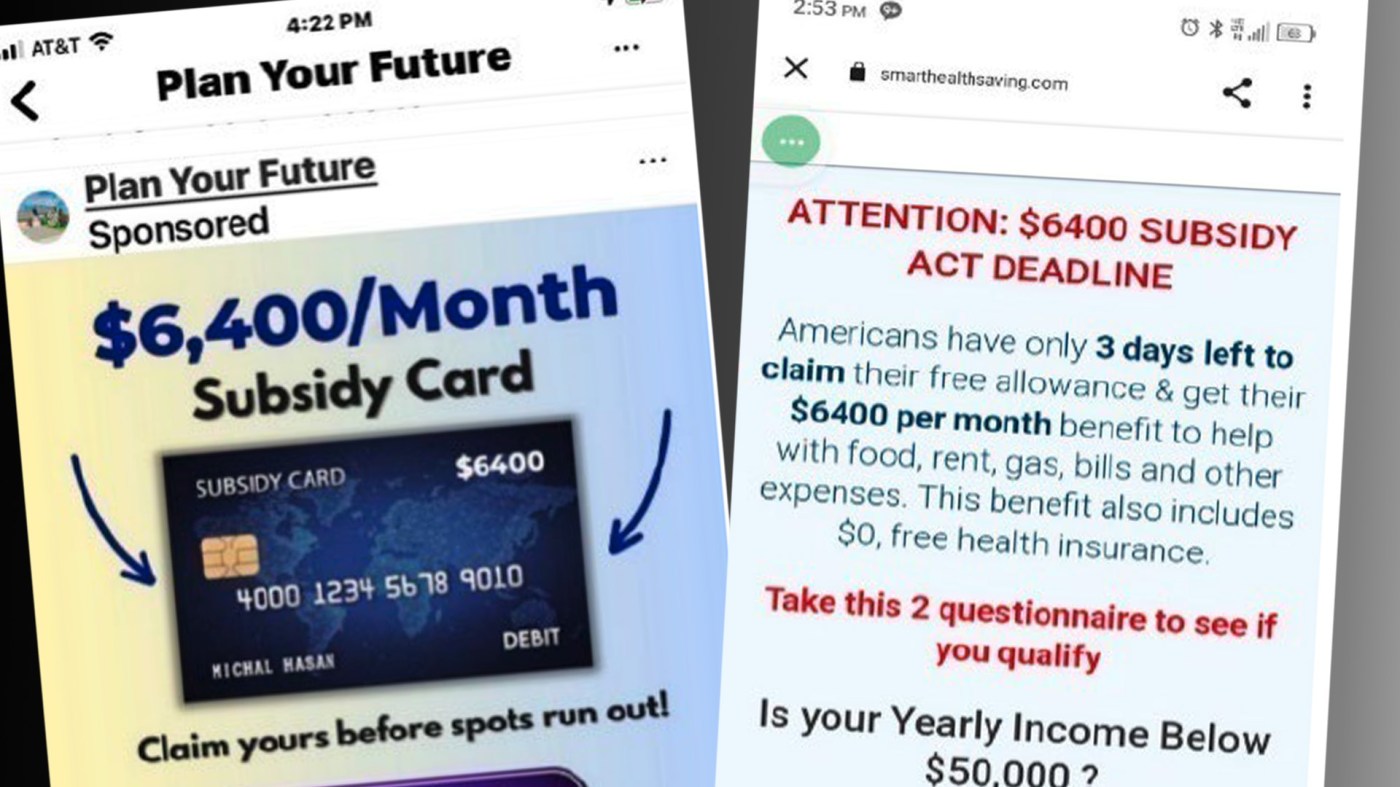

As open enrollment for Affordable Care Act plans continues through Jan. 15, you’re likely seeing fewer social media ads promising monthly cash cards worth hundreds, if not thousands, of dollars that you can use for groceries, medical bills, rent and other expenses.

But don’t worry. You haven’t missed out on any windfalls. Clicking on one of those ads would not have provided you with a cash card — at least not worth hundreds or thousands.

But you might have found yourself switched to a health insurance plan you did not authorize, unable to afford treatment for an unforeseen medical emergency, and owing thousands of dollars to the IRS, according to an ongoing lawsuit against companies and individuals who plaintiffs say masterminded the ads and alleged scams committed against millions of people who responded to them.

The absence of those once-ubiquitous ads are likely a result of the federal government suspending access to the ACA marketplace for two companies that market health insurance out of South Florida offices, amid accusations they used “fraudulent” ads to lure customers and then switched their insurance plans and agents without their knowledge.

In its suspension letter, the Centers for Medicare & Medicaid Services (CMS) cited “credible allegations of misconduct” in the agency’s decision to suspend the abilities of two companies — TrueCoverage (doing business as Inshura) and BenefitAlign — to transact information with the marketplace.

CMS licenses and monitors agencies that use their own websites and information technology platforms to enroll health insurance customers in ACA plans offered in the federal marketplace.

Suit names long list of defendants

The alleged scheme affected millions of consumers, according to a lawsuit winding its way through U.S. District Court in Fort Lauderdale that seeks class-action status.

An amended version of the suit, filed in August, increased the number of defendants from six to 12:

— TrueCoverage LLC, an Albuquerque, New Mexico-based health insurance agency with large offices in Miami, Miramar and Deerfield Beach. TrueCoverage is a sub-tenant of the South Florida Sun Sentinel in a building leased by the newspaper in Deerfield Beach.

— Enhance Health LLC, a Sunrise-based health insurance agency that the lawsuit says was founded by Matthew Herman, also named as a defendant, with a $150 million investment from hedge fund Bain Capital’s insurance division. Bain Capital Insurance Fund LP is also a defendant.

— Speridian Technologies LLC, accused in the lawsuit of establishing two direct enrollment platforms that provided TrueCoverage and other agencies access to the ACA marketplace.

— Benefitalign LLC, identified in the suit as one of the direct enrollment platforms created by Speridian. Like Speridian and TrueCoverage, the company is based in Albuquerque, New Mexico.

— Number One Prospecting LLC, doing business as Minerva Marketing, based in Fort Lauderdale, and its founder, Brandon Bowsky, accused of developing the social media ads that drove customers — or “leads” — to the health insurance agencies.

— Digital Media Solutions LLC, doing business as Protect Health, a Miami-based agency that the suit says bought Minerva’s “fraudulent” ads. In September, the company filed for Chapter 11 protection from creditors in United States Bankruptcy Court in Texas, which automatically suspended claims filed against the company.

— Net Health Affiliates Inc., an Aventura-based agency the lawsuit says was associated with Enhance Health and like it, bought leads from Minerva.

— Garish Panicker, identified in the lawsuit as half-owner of Speridian Global Holdings and day-to-day controller of companies under its umbrella, including TrueCoverage, Benefitalign and Speridian Technologies.

— Matthew Goldfuss, accused by the suit of overseeing and directing TrueCoverage’s ACA enrollment efforts.

All of the defendants have filed motions to dismiss the lawsuit. The motions deny the allegations and argue that the plaintiffs failed to properly state their claims and lack the standing to file the complaints.

Defendants respond to requests for comment

The Sun Sentinel sent requests for comment and lists of questions about the cases to four separate law firms representing separate groups of defendants.

Three of the law firms — one representing Brandon Bowsky and Number One Prospecting LLC d/b/a Minerva Marketing, and two others representing Net Health Affiliates Inc. and Bain Capital Insurance Fund — did not respond to the requests.

A representative of Enhance Health LLC and Matthew Herman, Olga M. Vieira of the Miami-based firm Quinn Emanuel Urquhart & Sullivan LLP, responded with a short message saying she was glad the newspaper knew a motion to dismiss the charges had been filed by the defendants. She also said that, “Enhance has denied all the allegations as reported previously in the media.”

Catherine Riedel, a communications specialist representing TrueCoverage LLC, Benefitalign LLC, Speridian Technologies LLC, Girish Panicker and Matthew Goldfuss, issued the following statement:

“TrueCoverage takes these allegations very seriously and is responding appropriately. While we cannot comment on ongoing litigation, we strongly believe that the allegations are baseless and without merit.

“Compliance is our business. The TrueCoverage team records and reviews every call with a customer, including during Open Enrollment when roughly 500 agents handle nearly 30,000 calls a day. No customer is enrolled into any policy without a formal verbal consent given by the customer. If any customer calls in as a result of misleading content presented by third-party marketing vendors, agents are trained to correct such misinformation and action is taken against such third-party vendors.”

Through Riedel, the defendants declined to answer follow-up questions, including whether the company remains in business, whether it continues to enroll Affordable Care Act clients, and whether it is still operating its New Mexico call center using another affiliated technology platform.

Lawsuit: COVID relief package made ‘scheme’ possible

The suspension notification from the Centers for Medicare and Medicaid Services letter cites several factors, including the histories of noncompliance and previous suspensions. The letter noted suspicion that TrueCoverage and Benefitalign were storing consumers’ personally identifiable information in databases located in India and possibly other overseas locations in violation of the centers’ rules.

The letter also notes allegations against the companies in the pending lawsuit that “they engaged in a variety of illegal practices, including violations of the (Racketeer Influenced & Corrupt Organizations, or RICO Act), misuse of consumer (personal identifiable information) and insurance fraud.”

The amended lawsuit filed in August names as plaintiffs five individuals who say their insurance plans were changed and two agencies who say they lost money when they were replaced as agents.

The lawsuit accuses the defendants of 55 counts of wrongdoing, ranging from running ads offering thousands of dollars in cash that they knew would never be provided directly to consumers, switching millions of consumers into different insurance policies without their authorization, misstating their household incomes to make them eligible for $0 premium coverage, and “stealing” commissions by switching the agents listed in their accounts.

TrueCoverage, Enhance Health, Protect Health, and some of their associates “engaged in hundreds of thousands of agent-of-record swaps to steal other agents’ commissions,” the suit states. “Using the Benefitalign and Inshura platforms, they created large spreadsheet lists of consumer names, dates of birth and zip codes.” They provided those spreadsheets to agents, it says, and instructed them to access platforms linked to the ACA marketplace and change the customers’ agents of record “without telling the client or providing informed consent.”

“In doing so, they immediately captured the monthly commissions of agents … who had originally worked with the consumers directly to sign them up,” the lawsuit asserts.

TrueCoverage employees who complained about dealing with prospects who called looking for cash cards were routinely chided by supervisors who told them to be vague and keep making money, the suit says.

When the Centers for Medicare and Medicaid Services began contacting the company in January about customer complaints, the suit says TrueCoverage enrollment supervisor Matthew Goldfuss sent an email instructing agents “do not respond.”

How it started

The lawsuit states the “scheme” was made possible in 2021 when Congress passed the American Rescue Plan Act in the wake of the COVID pandemic.

The act made it possible for Americans with household incomes between 100% and 150% of the federal poverty level to pay zero in premiums and it enabled those consumers to enroll in ACA plans all year round, instead of during the three-month open enrollment period from November to January.

Experienced health insurance brokers recognized the opportunity presented by the changes, the lawsuit says. More than 40 million Americans live within 100% and 150% of the federal poverty level, while only 15 million had ACA insurance at the time.

The defendants developed or benefited from online ads, the lawsuit says, which falsely promised “hundreds and sometimes thousands of dollars per month in cash benefits such as subsidy cards to pay for common expenses like rent, groceries, and gas.”

Consumers who clicked on the ads were brought to a landing page that asked a few qualifying questions, and if their answers suggested that they might qualify for a low-cost or no-cost plan, they were provided a phone number to a health insurance agency.

There was a major problem with the plan, according to the lawsuit. “Customers believe they are being routed to someone who will send them a free cash card, not enroll them in health insurance.” By law, the federal government sends subsidies for ACA plans to insurance companies, and not to individual consumers.

Scripts were developed requiring agents not to mention a cash card, and if a customer mentions a cash card, “be vague” and tell the caller that only the insurance carrier can provide that information, the lawsuit alleges.

In September, the defendants filed a motion to dismiss the claims. In addition to denying the charges, they argued that the class plaintiffs lacked the standing to make the accusations and failed to demonstrate that they suffered harm. The motion also argued that the lawsuit’s accusations failed to meet requirements necessary to claim civil violations of the RICO Act.

Miami-based attorney Jason Kellogg, representing the plaintiffs, said he doesn’t expect a ruling on the motion to dismiss the case for several months.

The complaint also lists nearly 50 companies, not named as defendants, that it says fed business to TrueCoverage and Enhance Health. Known in the industry as “downlines,” most operate in office parks throughout South Florida, the lawsuit says.

Complaints from former employees and clients

The lawsuit quotes former TrueCoverage employees complaining about having to work with customers lured by false cash promises in the online ads.

A former employee who worked in the company’s Deerfield Beach office was quoted in the lawsuit as saying that senior TrueCoverage and Speridian executives “knew that consumers were calling in response to the false advertisements promising cash cards and they pressured agents to use them to enroll consumers into ACA plans.”

A former human resources manager for TrueCoverage said sales agents frequently complained “that they did not feel comfortable having to mislead consumers,” the lawsuit said.

Over two dozen agents “came to me with these complaints and showed me the false advertisements that consumers who called in were showing them,” the lawsuit quoted the former manager as saying.

For much of the time the companies operated, the ACA marketplace enabled agents to easily access customer accounts using their names and Social Security numbers, change their insurance plans and switch their agents of record without their knowledge or authorization, the lawsuit says.

This resulted in customers’ original agents losing their commissions and many of the policyholders finding out they suddenly owed far more for health care services than their original plans had required, the suit states.

It says that one of the co-plaintiffs’ health plans was changed at least 22 times without her consent. She first discovered that she had lost her original plan when she sought to renew a prescription for her heart condition and her doctor told her she did not have health insurance, the suit states.

Another co-plaintiff’s policy was switched after her husband responded to one of the cash card advertisements, the lawsuit says. That couple’s insurance plan was switched multiple times after a TrueCoverage agent excluded the wife’s income from an application so the couple would qualify. Later, they received bills from the IRS for $4,300 to cover tax credits issued to pay for the plans.

CMS barred TrueCoverage and BenefitAlign from accessing the ACA marketplace.

It said it received more than 90,000 complaints about unauthorized plan switches and more than 183,500 complaints about unauthorized enrollments, but the agency did not attribute all of the complaints to activities by the two companies.

In addition, CMS restricted all agents’ abilities to alter policyholders’ enrollment information, the lawsuit says. Now access is allowed only for agents that already represent policyholders or if the policyholder participates in a three-way call with an agent and a marketplace employee.

Between June and October, the agency barred 850 agents and brokers from accessing the marketplace “for reasonable suspicion of fraudulent or abusive conduct related to unauthorized enrollments or unauthorized plan switches,” according to an October CMS news release.

The changes resulted in a “dramatic and sustained drop” in unauthorized activity, including a nearly 70% decrease in plan changes associated with an agent or broker and a nearly 90% decrease in changes to agent or broker commission information, the release said.

It added that while consumers were often unaware of such changes, the opportunity to make them provided “significant financial incentive for non-compliant agents and brokers.”

But CMS’ restrictions might be having unintended consequences for law-abiding agents and brokers.

A story published by Insurance News Net on Nov. 11 quoted the president of the Health Agents for America (HAFA) trade group as saying agents are being suspended by CMS after being flagged by a mysterious algorithm that no one can figure out.

The story quotes HAFA president Ronnell Nolan as surmising, “maybe they wrote too many policies on the same day for people who have the same income or they’re writing too many policies on people of a certain occupation.”

Nolan continued, “We have members who have thousands of ACA clients. They can’t update or renew their clients. So those consumers have lost access to their professional agent, which is simply unfair.”

Ron Hurtibise covers business and consumer issues for the South Florida Sun Sentinel. He can be reached by phone at 954-356-4071, on Twitter @ronhurtibise or by email at rhurtibise@sunsentinel.com.