Nassour: What happens when no one is watching the money

It shouldn’t have to be said, but here we are: waste, fraud, and abuse of taxpayer dollars is wrong. It’s showing up with alarming frequency across the county.

What used to be dismissed as a “one-off” scandal or an unfortunate oversight is starting to look like something much bigger. What’s becoming harder to ignore is who appears to be benefiting when oversight collapses.

A recent national survey from the Cato Institute found that Americans believe the federal government wastes 59 cents of every dollar it spends. Ninety-eight percent of Americans think there is at least some waste, fraud, or abuse in government spending, and two-thirds say there’s a considerable amount. Nearly nine in ten Americans support auditing all government spending to root it out.

People clearly don’t feel respected by how their money is being handled.

In Minnesota, investigators and journalists have raised serious questions about fraud schemes tied to networks that disproportionately benefited non-citizens, while the families actually paying into the system were left footing the bill. We’ve all seen the reports of luxury homes, high-end vehicles, and designer apparel funded by programs meant to serve children and low-income families. It’s hard not to see that as profoundly unpatriotic.

Here’s the part many are forgetting: taxpayer dollars don’t magically appear. American families work hard for their money. They clock in early, work late, juggle child care, groceries, rent or mortgage payments, student loans, and utility bills that seem to rise every month. They budget carefully because they have to. When the government takes a larger share of that paycheck, the expectation is simple: don’t waste it.

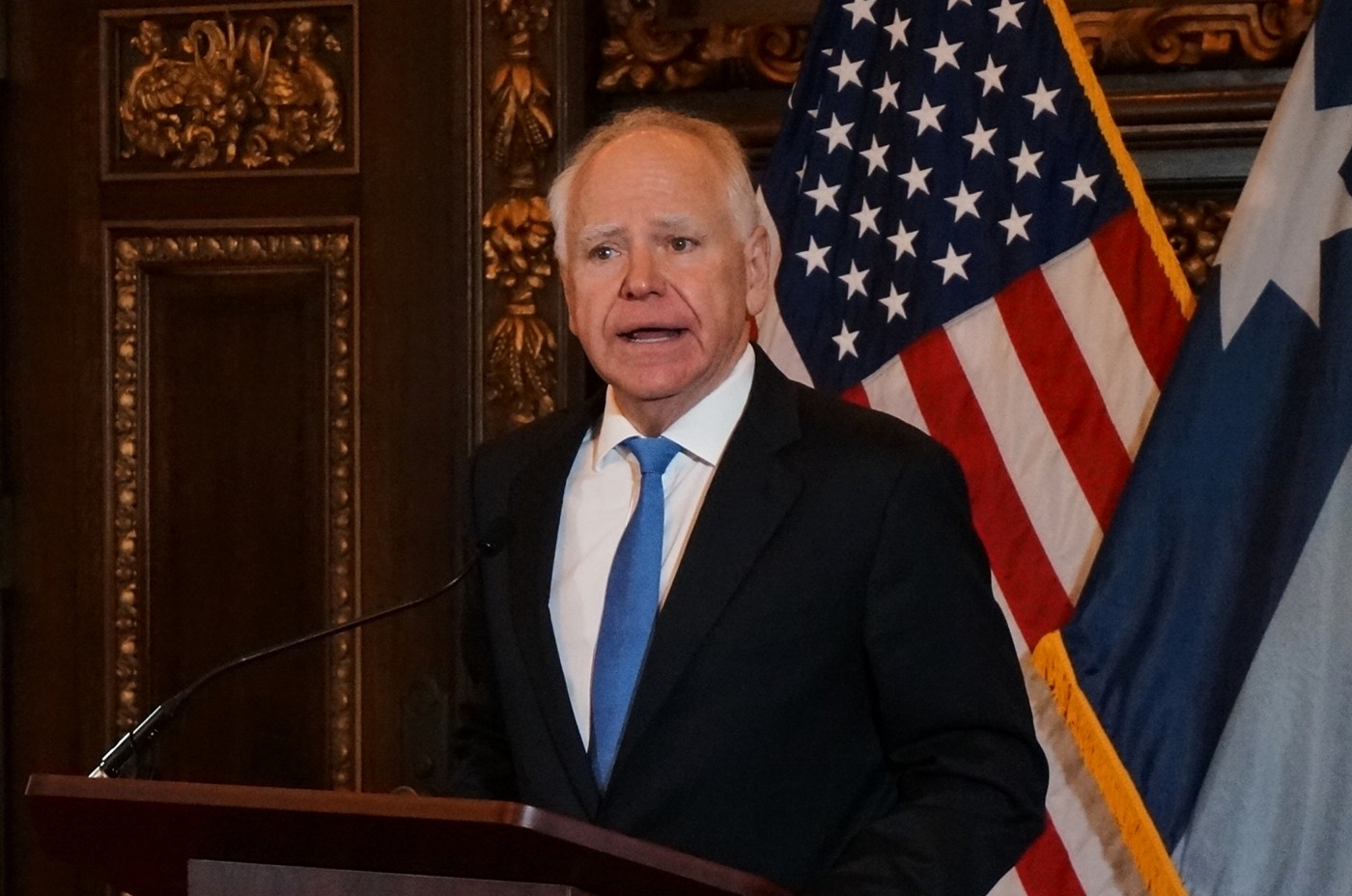

When Minnesota’s fraud scandals finally reached a boiling point, Governor Tim Walz did the bare minimum. He stepped away from his 2026 re-election campaign, saying, “I’m more committed to this state than I’ve ever been.” But it’s too late. The damage is already done, and the full scope of what happened there is still coming into focus. This hits home for us in Massachusetts, and residents should be paying attention. The warning signs are starting to look very familiar.

Here at home, two men were charged in a SNAP benefits fraud scheme costing taxpayers more than $7 million. Prosecutors allege the defendants sold meal packs intended for vulnerable families overseas and exchanged millions in benefits for cash. That money was meant to help feed children and support those in need. Instead, it was siphoned off and exploited.

And while $7 million is bad, it barely registers compared to what Massachusetts taxpayers have already absorbed.

The state burned through more than a billion dollars on failed migrant shelter plans, with little to show for it. When questions began piling up, detailed public reporting quietly stopped. Transparency didn’t improve. It disappeared. If that doesn’t raise alarm bells, it should.

This is exactly how Minnesota’s Feeding Our Future scandal unfolded. The program was rolled out under the banner of compassion. Oversight was lax. Internal warnings were brushed aside. Auditors flagged problems that went unaddressed. And all the while, checks kept going out the door. By the time federal prosecutors stepped in, hundreds of millions had been stolen, and taxpayers were left holding the bag.

Leadership isn’t acting surprised after the money is gone. Leadership is asking hard questions before it ever leaves the treasury.

Massachusetts now risks repeating the same mistakes.

Nearly one in seven Massachusetts residents receives SNAP benefits, a rate far higher than neighboring states like New Hampshire, Vermont, and Connecticut. Investigators and court records have raised concerns about childcare providers that refused inspections, failed to respond to scheduled visits, and reported enrollment numbers that did not align with reality. These aren’t minor administrative errors. They’re glaring red flags.

And when red flags are ignored, fraud thrives.

Every dollar stolen is a dollar taken from a working family. It’s money that could have stayed in a household budget to pay for groceries, heating oil, child care, or tuition. Instead, it’s funneled into systems that are long on slogans and short on accountability.

The common thread between Minnesota and Massachusetts isn’t ideology. It’s governance: one-party dominance, bloated bureaucracies, weak oversight, and leaders who confuse intentions with results. My concern is that we’re only at the tip of the iceberg when it comes to fraud. There’s more coming, and we’ll be paying attention.

Jennifer Nassour is the co-founder of the Pocketbook Project, host of the Political Contessa Podcast, and former Chair of the Massachusetts GOP.