Netflix revises its offer for Warner Bros. Discovery to make it an all-cash transaction

By MICHELLE CHAPMAN, Associated Press Business Writer

Netflix is revising its $72 billion offer for Warner Bros. Discovery to make it an all-cash transaction.

Related Articles

US futures and other world shares sink on worries over Trump’s push to claim Greenland

NYSE working on a new platform for trading digital tokens around the clock

Hours after ABC News ran a story about Mischief Toy Store, ICE agents arrived at their door

How to conduct your own portfolio makeover

Inequality and unease are rising as elite Davos event opens with pro-business Trump set to attend

Netflix initially put forth a cash and stock deal valued at $27.75 per Warner Bros. share, giving it a total enterprise value of $82.7 billion, including debt.

Netflix and Warner Bros. said Tuesday that the revised deal simplifies the transaction structure, provides more certainty of value for Warner Bros. stockholders and speeds up the path to a Warner Bros. shareholder vote.

The companies said that the all-cash transaction is still valued at $27.75 per Warner Bros. share. Warner Bros. stockholders will also receive the additional value of shares of Discovery Global following its separation from Warner Bros.

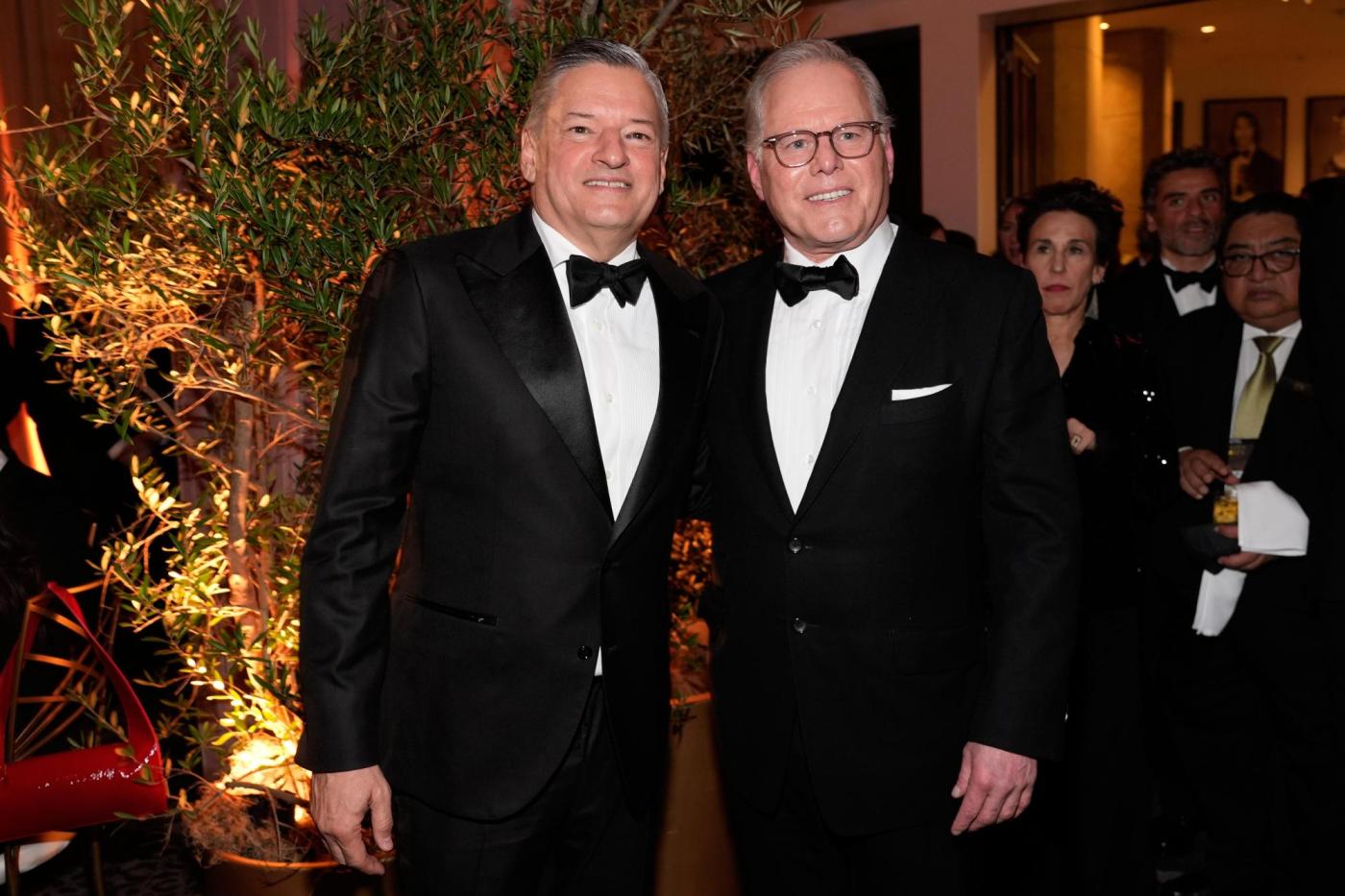

“Together, Netflix and Warner Bros. will deliver broader choice and greater value to audiences worldwide, enhancing access to world-class television and film both at home and in theaters,” Ted Sarandos, co-CEO of Netflix, said in a statement. “The acquisition will also significantly expand U.S. production capacity and investment in original programming, driving job creation and long-term industry growth.”

Warner Bros. previously announced that it will separate Warner Bros. and Discovery Global into two separate publicly traded companies. The separation is expected to be completed in six to nine months, prior to the closing of the proposed Netflix and Warner Bros. deal. The transaction with Netflix is expected to close 12 to 18 months from the date that Netflix and Warner Bros. originally entered into their merger agreement.

Both companies’ boards approved the amended all-cash deal.

Netflix has been in a tussle with Paramount Skydance for Warner Bros., with Paramount taking another step in its hostile takeover bid of Warner Bros. last week, saying that it would name its own slate of directors before the next shareholder meeting of the Hollywood studio.

Paramount also filed a suit in Delaware Chancery Court seeking to compel Warner Bros. to disclose to shareholders how it values its bid and the competing offer from Netflix.

Warner’s leadership has repeatedly rebuffed overtures from Paramount — and urged shareholders to back the sale of its streaming and studio business to Netflix. Paramount, meanwhile, has made efforts to sweeten its $77.9 billion hostile offer for the entire company.

Netflix’s stock rose 1.3% before the market open, while shares of Warner Bros. Discovery fell slightly.