Dakota County school districts asking voters for funding bump this fall

“Marshmallow!” said digital learning specialist Jon Abrahamson to his Monday morning class, sending his fifth-graders shuffling to their tables, grabbing their Chromebook computers, ready for that day’s lesson in Digital Learning at William Byrne Elementary School.

The Burnsville students put their computers to use as part of the Burnsville-Eagan-Savage School District’s one-to-one laptop program, a measure that the district is asking voters to fund once again this fall.

Four public school districts in Dakota County are asking voters to approve funding bumps or renewals this election season, as school administrators say they need to balance their budgets amid expiring levies and rising costs in education.

Public school districts in Farmington, Lakeville and Inver Grove Heights are seeking approval for funding day-to-day operating expenses, while Burnsville-Eagan-Savage is seeking to renew a capital projects levy, known commonly in the district as the “tech levy.” This is how District 191 funds technology-related initiatives like student laptops, tech infrastructure and licensing of certain programs, among other items.

Even after a $2.2 billion investment in public schools from the state Legislature in 2023, many districts across the state have had to trim their budgets as they adjust to the end of COVID-era funding and rising operational costs. Older districts are dealing with the additional gut punch of declining enrollment, the student population headcount that is tied to state aid.

Attend any public school district budget presentation, regardless of the location, and the talk is bound to move toward a graph showing state public school funding since 2003 compared to inflation, and the gap between the two lines.

It’s a measure many school finance officials point to when beginning the conversation about asking taxpayers to approve additional funding through local property taxes. The gap of $1,356 per pupil leaves a different shortfall for each school district, but for Inver Grove Heights Community Schools, for example, it translates to about $5 million.

A fall 2024 graph shows state funding for Inver Grove Heights Community Schools since 2003 compared to inflation. (Courtesy of Inver Grove Heights Community Schools)

“We are grateful for that increased funding in the last biennium, but I think what that graph tells us is that we aren’t going to catch up with inflation in one biennium,” said Kirk Schneidawind, executive director of the Minnesota Schools Boards Association. “It was a great step forward, but this effort needs to continue to show a meaningful investment for our public schools.”

Statewide, 54 school districts this fall will ask their local taxpayers to approve an operating levy, capital projects levy or a construction bond, according to figures provided by the MSBA.

Of the 331 public school districts in Minnesota, MSBA figures found that about 73 percent of all districts have a taxpayer-approved operating referendum in some form.

“We used to call it an ‘excess levy.’ Now it has become such an important part of school district budgets,” Schneidawind said. “That in itself speaks to the larger economic pressures that our districts are feeling over the last two decades. (Levies) have become an essential element for our school districts to fund their operations.”

Related Articles

University of Wisconsin fires former porn-making chancellor who wanted to stay on as a professor

Key child care advocacy group stays mum on St. Paul’s child care subsidy ballot question

Two years after being identified, University of North Dakota is returning Native American remains to tribal nations

‘Profoundly changing lives’: Catholic Charities early education director wins national recognition

‘Trailblazer,’ longtime St. Paul educator Shirley Kaiser celebrated

Asked if is this is a sign of a state funding problem or just healthy local engagement, Catrin Wigfall, an education policy fellow at the conservative-minded think tank Center of the American Experiment, replied that the issue is multi-layered; identifying what has kept pace with inflation is important, because overall state revenue has.

Additionally, she said, it doesn’t help if new state aid comes attached to new state mandates before it hits the schools’ budget sheets.

“If the districts are making the case at the local level that the referendum is needed, being transparent about what budget decisions have gotten them to this point, and showing their community how the money will be spent, and the community approves, I see that as healthy local engagement,” Wigfall said.

Farmington: Another try, different way of asking

In Farmington, the school district is asking taxpayers to replace its existing levy of almost $700 per student with a larger levy of $1,556.15 per student. This levy would last 10 years, and would be tied to inflationary increases, as well. The current 10-year levy is set to expire at the end of 2025.

If approved, property taxes for a Farmington resident would rise about $35.50 per month or $425 a year, based on a home valued at $350,000, according to district estimates.

Last year, the community rejected a similar operating levy question in Farmington by about 53 percent against to 47 percent in favor.

District officials said they received feedback from community members that the question last year may have been a bit convoluted — it involved asking for a lower amount at the beginning of the levy, and increasing that amount as other debt fell off the district’s books. The Farmington Board of Education last year also brought forward that levy question a few months before Election Day. This year, the board made that vote in the spring, giving the district more time to speak with residents.

When the 2023 levy did not pass, the district chose to use $2.7 million of one-time funds to hold off any additional budget cuts. But if this year’s effort fails, the district has estimated needing to make reductions next year of about $4 million from the district’s $96 million budget. Before using those one-time funds last budget season, Farmington schools have had to make budget cuts in each of the previous three years.

Farmington Area Public Schools Superintendent Jason Berg said those reductions would likely include reducing support staff positions, classroom teacher positions, eliminating fifth-grade band and post-secondary learning options at Farmington High School.

Berg said last year the district was able to be a bit creative in developing the operating levy question, but with the current funding source expiring at the end of 2025, that time is running low.

“This year, we are getting backed up against the wall,” Berg said.

Inver Grove Heights: ‘It’s for survival’

That’s similar to the refrain of school officials in Inver Grove Heights.

Last year, Inver Grove Heights schools asked taxpayers two funding questions, but were rebuffed on both, by 53 percent and 54 percent. The first question would have added $410 per student to the operating levy in order to hold off classroom staffing cuts, and offer K-8 world language classes, among other items. The second question last year would have added $110 per student to provide for mental health and school safety support.

This fall, voters will choose whether to increase Inver Grove Heights Schools’ operating levy by $627 per student, tied to inflationary increases, for the next decade. That would bring the district’s levy to $1,337.

This increase would cost taxpayers about $13.75 per month on a $317,250 home, or the average home value in the district.

They are coming back to taxpayers this fall after completing a survey with national research firm Morris Leatherman Co., finding that 75 percent of respondents would support increasing the district’s operating levy. Inver Grove Heights schools currently receive $710 per student, more than $1,000 below the per pupil operating levies of nearby school districts in Rosemount, South St. Paul and West St. Paul. Those districts tally per pupil funding of $1,887, $1,990 and $2,158, respectively.

“It’s for survival,” Inver Grove Heights Schools Superintendent Dave Bernhardson said. “State funding hasn’t kept pace with inflation since 2003. We can’t control that. We can lobby for that, and we can also ask our local residents to help patch that gap with what they said they could afford.”

Inver Grove Heights cut $1.8 million ahead of the 2024-25 school year, and if this levy fails, officials are predicting another shortfall of $2 million.

Bernhardson said those reductions could result in elementary class sizes of more than 30 students, with middle school and high school sections seating more than 40 students.

If the measure passes, the district will be able to keep those teachers on staff, as well as hire an additional school resource officer, and update security cameras in the district, among other safety equipment.

Lakeville North: Growth in enrollment, growth in needs

When Lakeville North High School counselors Bryce Hoffa, Jennie Peitz and Isaac McClosky open up their daily schedules to speak with students, the online forms quickly fill up. The 30-minute blocks are grabbed, one after the other, until the day is full.

So it goes for the counseling team at Lakeville North, whose district added three counselors to each of its two high schools this year.

“We have been steady busy, all day, every day, which is great for us,” Hoffa said. “We are connecting with students and we are fulfilling and supporting their needs in the moment.”

The counselors focus on three main domains: college applications and searches, general social-emotional mental health support, and career and post-secondary planning.

Bringing in more student support positions is a large focus of Lakeville’s levy plans, said Lakeville Area Schools spokesperson Grace Olson.

“It’s not as much about budget reductions for us. It’s more about knowing that we are continuing to grow. We’ve grown so much without adding enough support,” Olson said.

Voters will choose whether to increase the Lakeville district’s general operating levy by $300 per student, tied to inflationary increases, for the next decade. This increase would total about $4 million annually. Lakeville Area Schools receives about $1,671 per student from their current operating levies.

For homeowners of a $465,000 house — the average home value in the district — the new levy would be a tax increase of about $13 per month, according to district estimates.

If approved, Lakeville school officials said they would add nine counselor/social worker positions spread across three middle schools, and also one more counselor to each high school. They would also plan to add a full-time art and music teacher to each elementary school, among other items.

Last year, Lakeville schools asked voters two levy questions — one to fund operations for newly opened Highview Elementary and another to fund an increase of $250 per student for many of the same items listed in this year’s levy effort. The first question passed with almost 56 percent support, but the second measure failed by less than 1 percent, or 142 votes.

The administration of Lakeville Area Schools is also currently in transition. Douglas Van Zyl resigned his superintendent post in August, with Assistant Superintendent Emily McDonald currently serving as acting superintendent. Michael Baumann, who previously served as superintendent of Lakeville schools from 2017 to 2022, will serve as interim superintendent beginning Sept. 30.

Lakeville school board members and McDonald referred referendum questions to Olson.

Burnsville-Eagan-Savage: Renewing digital support

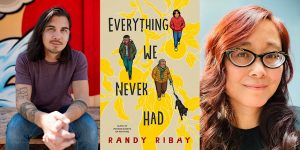

Fifth-grade students in Jon Abrahamson’s Digital Learning class, where the children are learning how to “be a responsible digital leader,” at William Byrne Elementary School in Burnsville on Monday, Sept. 23, 2024. As part of District 191’s technology levy, each student receives a Chromebook laptop to use between home and school. The taxpayer-approved tech levy provides about $4.7 million for technology initiatives across the Burnsville-Eagan-Savage district. (Elliot Mann / Special to the Pioneer Press)

Back in the Burnsville classroom, Abrahamson bounced from group to group, lending a hand when needed as his students worked on a project about digital leadership, or making positive choices when online or using technology.

The skills learned in his class will give the students a strong foundation with using technology as they move toward using their laptops in their other classes more and more, he said.

District leaders at Burnsville-Eagan-Savage schools are asking voters to renew the expiring capital projects levy for a 10-year period, beginning in 2026. The levy will provide nearly $4.7 million each year, for an approximate total of about $47 million over the life of the levy. There would be no immediate property tax change, since the levy is a renewal.

Last April, the District 191 school board found that community members strongly supported renewal of the levy, per their own survey results provided by the Morris Leatherman Co. In the survey, 89 percent of respondents supported renewing the “tech levy.”

Superintendent Theresa Battle said the funds will be used to implement cybersecurity measures to protect the district’s data, as online attacks against school districts have been more common in recent years. The levy will also support the district’s use of popular educational programming like Schoology, Seesaw and WeVideo, in addition to continuing the initiative to provide every student with a laptop.

Battle said providing each student with a laptop allows students to access information at their fingertips but also allows instructors to have immediate feedback from how their students are performing. In a growing digital age, online access is becoming a basic utility for teaching and learning.

“It is an opportunity to personalize learning,” Battle said.

Levies vs. bonds

Related Articles

Family man, veteran, paramedic: As fallen Burnsville firefighter’s name added to state memorial, co-workers remember him

Apple Valley native awarded Navy’s highest non-combat decoration for sea rescue

Ramsey County Board caps tax levy increase at 4.75%, but members frustrated with state funding

Longtime Mendota supper club Axel’s closing after nearly 30 years

Man gets 10-year prison term for Apple Valley shootout that killed ex-girlfriend

There are a few different taxpayer-approved funding mechanisms; the following will be on ballots this November:

Operating levies: Used for general, daily operating expenses within a district such as classroom staff, materials or programming changes.

Capital project levies: Used with a more limited scope, including items related to technology, building maintenance, safety and security infrastructure and similar items.

Construction bonds: Used to build or renovate buildings and district-owned spaces.

A common axiom used by many school finance officials to help differentiate between these mechanisms is “levies are for learning, bonds are for building.”