Microsoft, Nvidia to face US antitrust probes over AI moves

The U.S. is opening antitrust investigations into two of the world’s most valuable companies, Microsoft Corp. and Nvidia Corp., over their dominance of the rapidly emerging field of artificial intelligence, according to people familiar with the matter.

Microsoft has poured more than $13 billion into its partnership with OpenAI, tapping the startup’s generative-AI technology for the Bing search service, Edge internet browser and Windows. Nvidia, the world’s most valuable chipmaker, has acknowledged allocating its chips to customers it deems most likely to use them quickly, prompting concerns that it has too much power over the market for cutting-edge AI semiconductors.

The country’s two antitrust agencies also agreed to divide responsibility over AI. The Federal Trade Commission will handle the inquiry into Microsoft’s ties with OpenAI, while the Justice Department will probe Nvidia’s dominance in AI chips, said the people, who asked not to be named discussing inter-agency negotiations. The DOJ will retain oversight of Alphabet Inc.’s Google, the people said.

The agencies reached the deal in the last few days after more than six months of negotiations, the people said. The agreement gives each agency authority to open an antitrust probe into the conduct of the respective companies and their recent deals.

The FTC has also opened a probe into whether Microsoft failed to properly notify the antitrust agencies about its deal with Inflection AI, according to the people. In March, the Redmond, Washington-based software giant agreed to pay the startup $650 million to license its AI software and hired much of Inflection’s staff. The agency can levy fines if it determines Microsoft violated the law about reporting transactions.

A Microsoft spokeswoman said the company has not been contacted by the FTC regarding OpenAI.

“Our agreements with Inflection gave us the opportunity to recruit individuals at Inflection AI and build a team capable of accelerating Microsoft Copilot, while enabling Inflection to continue pursuing its independent business and ambition as an AI studio,” the company said in a statement. “We take our legal obligations to report transactions seriously and are confident that we have complied with those obligations.”

The DOJ, FTC, OpenAI, Google and Nvidia all declined to comment. The New York Times reported the FTC-DOJ agreement earlier.

The Justice Department and FTC jointly enforce U.S. antitrust laws and work together to coordinate which agency will investigate mergers and anticompetitive conduct through a process internally known as clearance. High-profile matters, such as those involving Google, have previously caused bitter clearance disputes between the agencies.

The deal was negotiated directly between Assistant Attorney General Jonathan Kanter and FTC Chair Lina Khan, the people said. The two met in person this week on the sidelines of a conference in Washington.

The Justice Department had initially proposed splitting up the cases by company, according to the people, taking for itself all antitrust issues related to Microsoft and giving the FTC anything related to Nvidia, the people said. The FTC has previous history with Nvidia, having overseen recent mergers and suing to stop the company from buying Arm Ltd. in December 2021. Nvidia then walked away from that deal.

The DOJ’s proposal tracks with past practice. With the exception of Microsoft’s recent acquisition of Activision Blizzard, Justice has overseen the company since 1993 and has deep familiarity with the search and browser markets owing to its recent cases against Google.

The FTC disagreed with that division of authority, arguing that it has the more relevant experience to take on Microsoft and that its consumer protection mandate means it’s in a better position to challenge potentially problematic conduct by AI startups.

The commission has been in the beginning stages of a probe into the cloud computing market, seeking public comments last year. As part of that inquiry, online rivals and others complained about both Amazon.com Inc. and Microsoft, the No. 1 and No. 2 cloud companies respectively, which control more than 55% of the market.

The agency also sought information from OpenAI last year as part of a probe into whether the company engaged in unfair or deceptive practices that caused “reputational harm” to consumers.

In January, the FTC opened an inquiry into Microsoft’s OpenAI investment as well as deals by Google and Amazon to invest in rival AI-startup Anthropic. The five-member agency didn’t inform the Justice Department before announcing that study, according to the people, which heightened tensions between the two agencies.

Last week, the Justice Department held a public workshop on competition in AI at Stanford University, featuring dozens of companies across the industry. While Nvidia was rarely mentioned by name, companies have said the scarcity of high-powered chips needed to train AI foundation models was significantly impacting the industry.

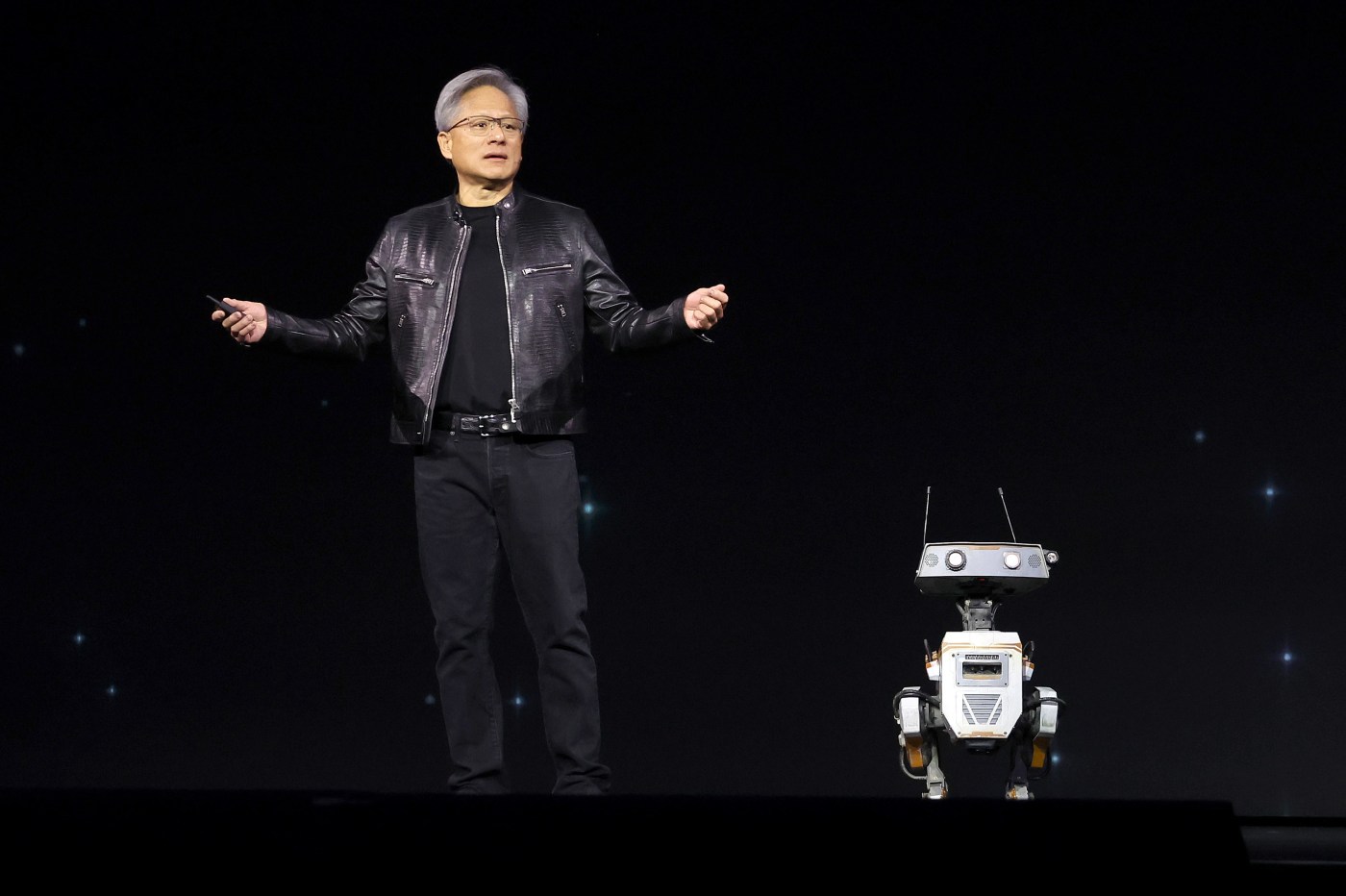

Nvidia’s leaders have openly acknowledged they allocate the supply of chips and other products to customers. They decide who gets what on the basis of whether or not the would-be recipient is able to immediately put those products to work in a data center that’s ready to go. This is a mechanism to ensure that data center operators don’t hoard chips, Nvidia has said.

The chip industry has long endured periods when there isn’t enough supply to meet demand, only to ramp up production and wind up with more chips than buyers. Recently Tesla Inc. founder Elon Musk said he’d diverted some of the Nvidia chips he’d ordered from Tesla to other companies he controls because the electric carmaker doesn’t have the space to immediately put them to work.

Overall Nvidia has said that it’s struggled to get enough supply from its manufacturing partners to meet the rapid surge in demand that it’s received. While that supply is improving, it’s likely to continue to fall short.

The European Union also looked at Microsoft’s investment in OpenAI but ultimately decided against a formal probe. The UK’s competition watchdog has also said it would examine the partnership but separately decided last month that a Microsoft deal with French AI company Mistral AI doesn’t qualify for an investigation.