New tax credit could net Minnesotans $1,750 per child. Here’s how to see if you’re eligible.

Starting this year, many Minnesota families will be eligible for their share of more than $400 million in new child tax credits from the state — with some families seeing up to $1,750 per child.

Minnesota’s Department of Revenue estimates around 300,000 households qualify for the credit, but since many might not typically owe taxes, state officials want to make sure they file for a return this year and in the future.

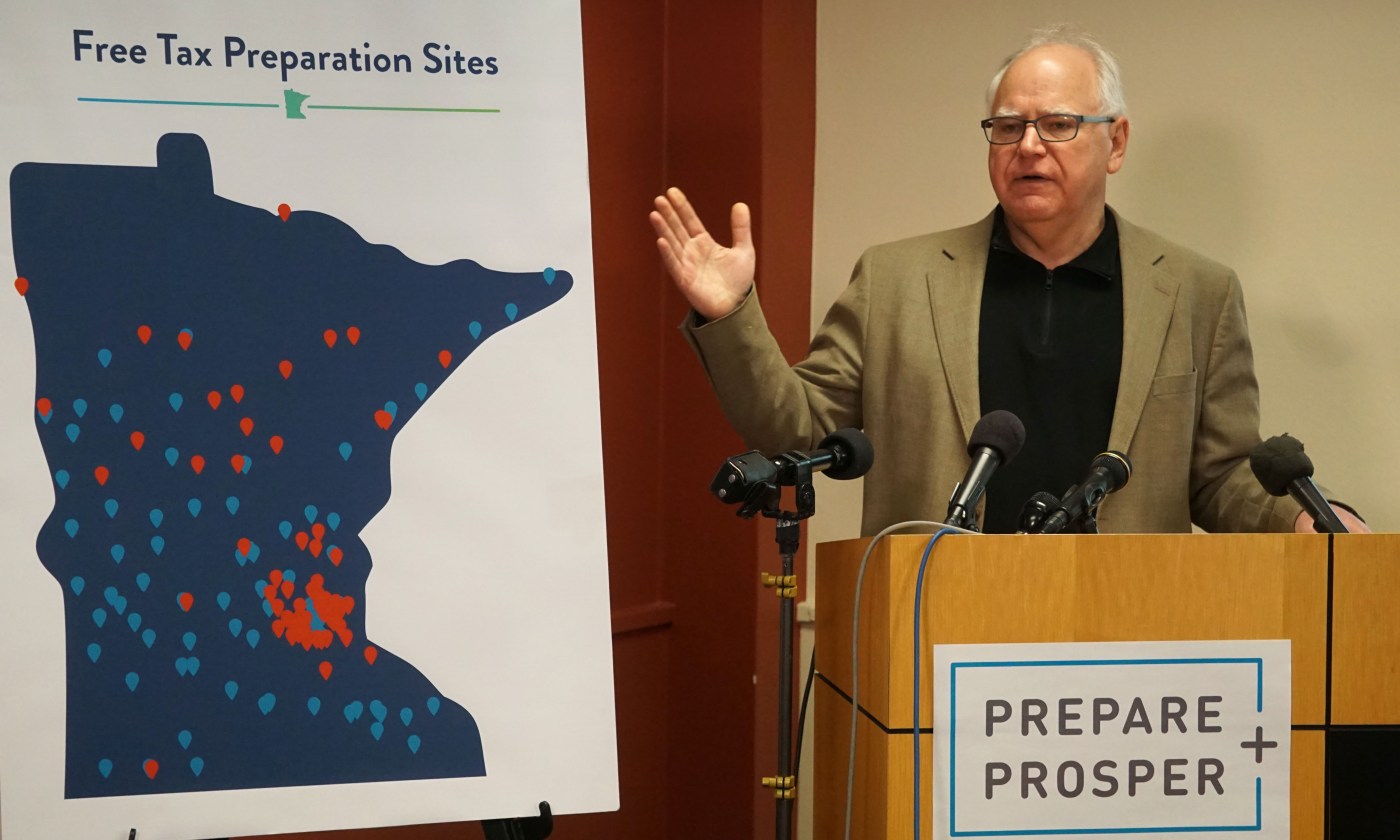

To get the word out, Gov. Tim Walz, Lt. Gov. Peggy Flanagan and Department of Revenue Commissioner Paul Marquart on Monday visited Prepare + Prosper, a free tax preparation nonprofit in St. Paul, to highlight services available to lower-income families.

“Even if you aren’t legally required to file taxes, you can still be eligible for the child tax credit, which is why it is so important for us to spread the word,” Flanagan said after meeting with tax preparation volunteers. “If you’ve never filed before, this is the year to start.”

Minnesota’s new child tax credits went into effect this year as part of a tax bill passed by the Democratic Labor-Farmer-Labor-controlled Legislature and signed into law by Walz in 2023. The state’s two-year state budget provides about $900 million in funding for the credit.

What is it?

The child tax credit was part of a slate of new tax credits and other programs the Walz administration says are aimed at making Minnesota “the best place in the country to raise a family.” Critics have called the credit an expansion of welfare billed as a tax cut.

Minnesota’s new child tax credit is similar to a temporary pandemic-era federal child tax credit that lasted for one year under the American Rescue Plan. Before that program expired, national child poverty was reduced by 46%, according to a U.S. Treasury Department report citing census data.

Walz and DFL lawmakers hope to continue that success by creating a similar permanent program in Minnesota.

“If this works, right by the end of the year Minnesota should have the lowest childhood poverty rates in the entire country,” Walz said.

Citing a study from the Center on Poverty and Social Policy at Columbia University, Walz administration officials say the credit could reduce child poverty in Minnesota by 33%. Right now, Minnesota’s poverty rate for children is about 8.5%, Walz said.

One week into tax season, 48,000 filers have claimed the child tax credit, about $61 million in total, according to revenue officials. On average families are getting about $1,253, Walz said.

More than half a million children are expected to be covered by the credit. The cost could grow if more families qualify than originally was estimated.

Who is eligible?

Parents who file taxes can get up to $1,750 for each child younger than 18. That amount begins to phase out for single filers earning more than $29,500 and joint filers earning more than $35,000 a year.

From those income levels, the amount decreases until it completely phases out depending on the number of children in a family.

For example, a couple with three children would start seeing the credit decrease at income levels above $35,000, and it would fully phase out at a combined income of $82,000.

There is no limit on the number of children for which a family can receive a tax credit.

The maximum income levels for each credit are as follows:

Joint filers

• One child: $52,500.

• Two children: $67,000.

• Three children: $82,000.

• Four children: $96,000.

Single filers:

• One child: $47,000.

• Two children: $61,500.

• Three children: $76,000.

• Four children: $91,000.

The limit increases with additional children after four for single and joint filers.

There is also a credit for families with qualifying children older than 17, starting at $925 for one qualifying child and with the same base level for a phase-out.

How to access free tax help

To maximize participation, Walz and officials in his administration are pointing people to free tax filing services across the state. They pointed to more than 170 free tax sites available for income and property tax returns with in-person and virtual options.

Prepare + Prosper, the nonprofit they visited on Monday, offers free tax filing services to individuals who earn less than $40,000 or less a year and households that earn $60,000 or less. They also offer people who make less than $79,000 a year free tax software with volunteer support.

There’s also help from the state through the Volunteer Income Tax Assistance program. People with an annual income less than $64,000, who are 60 or older, who have a disability or who speak limited or no English can qualify.

More information on free tax preparation can be found on the Department of Revenue’s website: revenue.state.mn.us/free-tax-preparation-sites.

Related Articles

Why are counties, GOP pushing against the Minnesota state flag and seal?

Vadnais Heights lawmaker Brion Curran sentenced for driving while impaired

Letters: Experimenting with ways to use less road salt in Minnesota

Fire at offices of conservative organizations in Golden Valley under investigation as arson, ATF says

MN rebates checks will be taxed by federal government this year