Recycling Money: How Cars, Watches, and Other Luxuries Can Grow Your Wealth

Conventional thinking (lead by manipulation from Car Dealers, Jewelers, & other luxury sellers) has lead people to believe that luxury items like cars and watches are liabilities that drain your wealth.

This forces most people to believe that they have to save up some insane amount of money to drive an exotic car, or achieve a salary level that’s simply out-of-reach in the near future.

That couldn’t be further from the truth.

In fact, it’s actually the mid-level luxuries and low-level consumables that drain your wealth. Things like lease payments, buying brand new cars, buying watches at MSRP (except Rolex), etc..

Today, I’m going to show you how these things can actually be assets that GROW your wealth, instead of liabilities that drain it, and how you can use the same compounding money over and over (recycling) to enjoy even better luxuries over time while your net worth grows.

Let’s run the numbers:

First, I want you to meet my friend, “Hypothetical Joe.”

Hypothetical Joe can have multiple personalities based on how he lives his life and spends his money.

He can be “Average Joe” (boring)…

Or he can be “Joe Exotic” (sexy, exciting, fun).

As a baseline, let’s assume Joe has $30,000 of savings in the bank and earns enough money to cover all his living expenses + $1500/mo to save or use on car payments & luxury spending.

He wants to get himself a sweet sports car with a budget of $1000/mo, and a luxury watch for no more than half of his savings.

Average Joe, who has never heard of Exotic Car Hacks or Watch Trading Academy, would do the following…

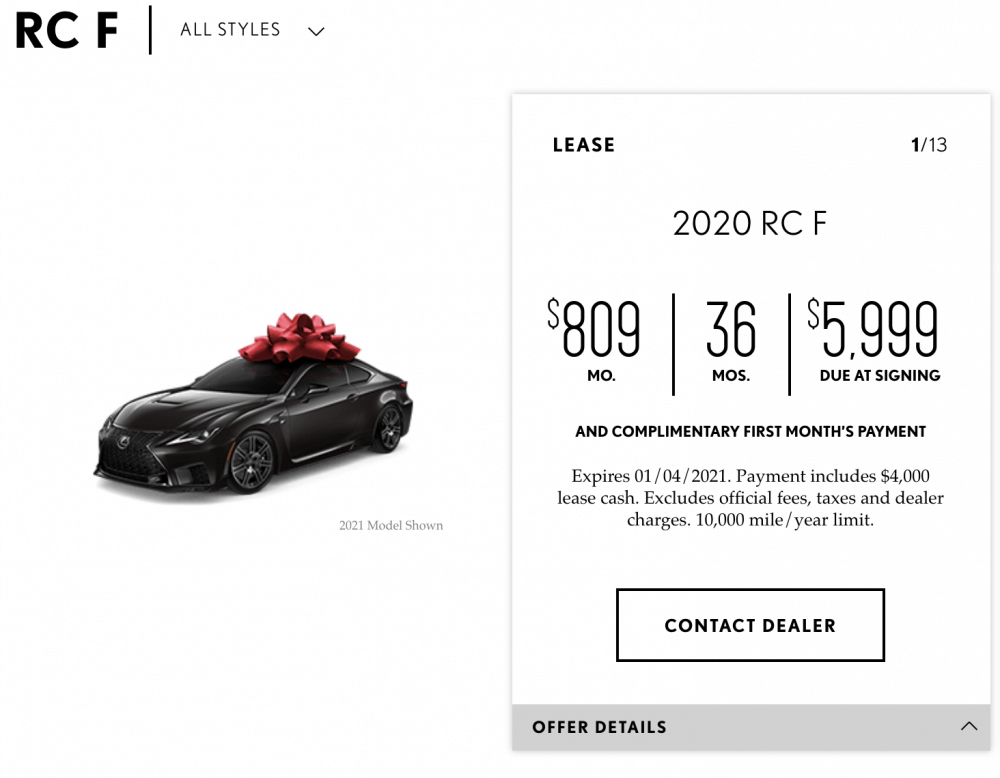

First, he decides to lease a new ride and finds an attractive offer for a Lexus RC-F. For $809/mo for 36 mos and $5,999 due at signing, his wheels are secure.

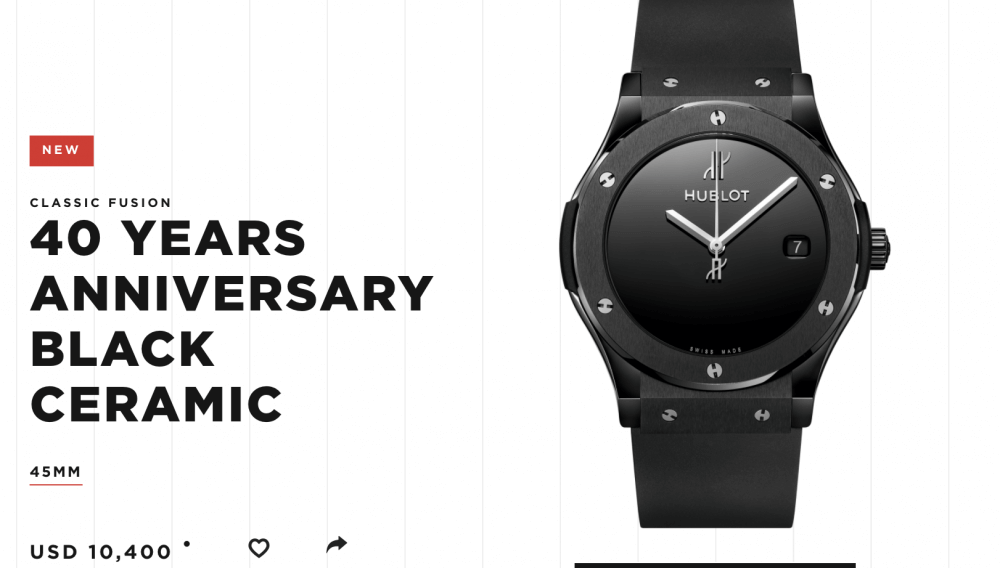

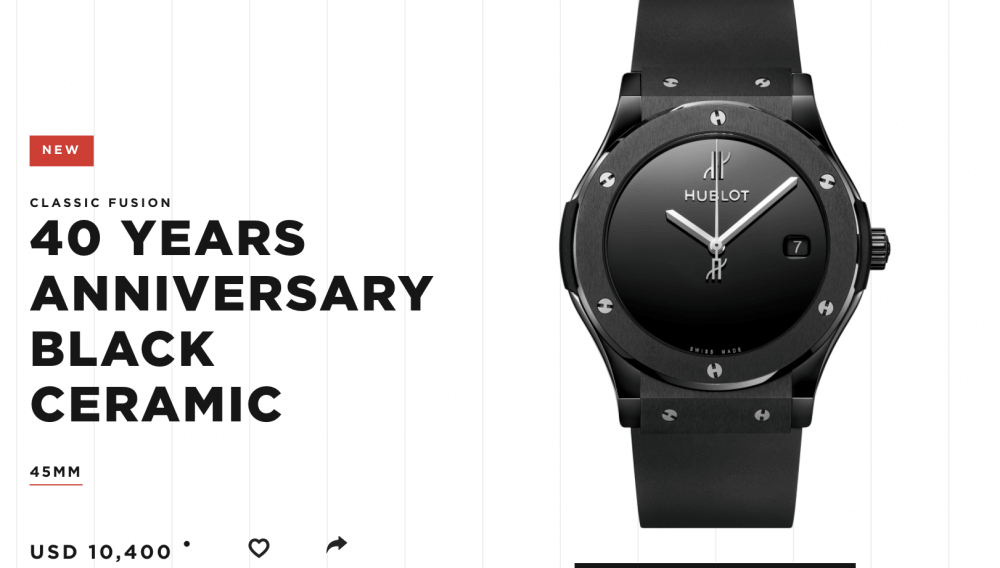

Then he hits up his local Hublot Boutique and for a cool $10,400 he buys a Classic Fusion Black Magic 45mm.

After one year, let’s look at the numbers for Average Joe:

Savings: $30,000 (starting) – $5,999 (downpayment) – $10,400 (watch) = $13,601

Cash in: $1,500* 12 = $18,000

Payments out: $809 * 12 = $9,708

Value of car if sold: $0 – since he is leasing the car there is no value being stored, and still $19,416 to be spent before the lease expires.

Residual value of watch: $5,000 (Source)

Net Wealth after 12 months: $26,893 (from $30,000)

On the other hand, what if he decides to invest in Watch Trading Academy and Exotic Car Hacks so he can learn how to enjoy his luxuries responsibly?

Enter Joe Exotic.

Joe Exotic realizes for his $1,000/mo payment he can afford a 2013 Nissan GTR. He finances the purchase price of $68,000 (after some negotiation) at 1.99% for 72 months for a payment of $1,003 per month. Let’s assume he has no trade-in credits and pays cash for taxes and tags at approx $4,500.

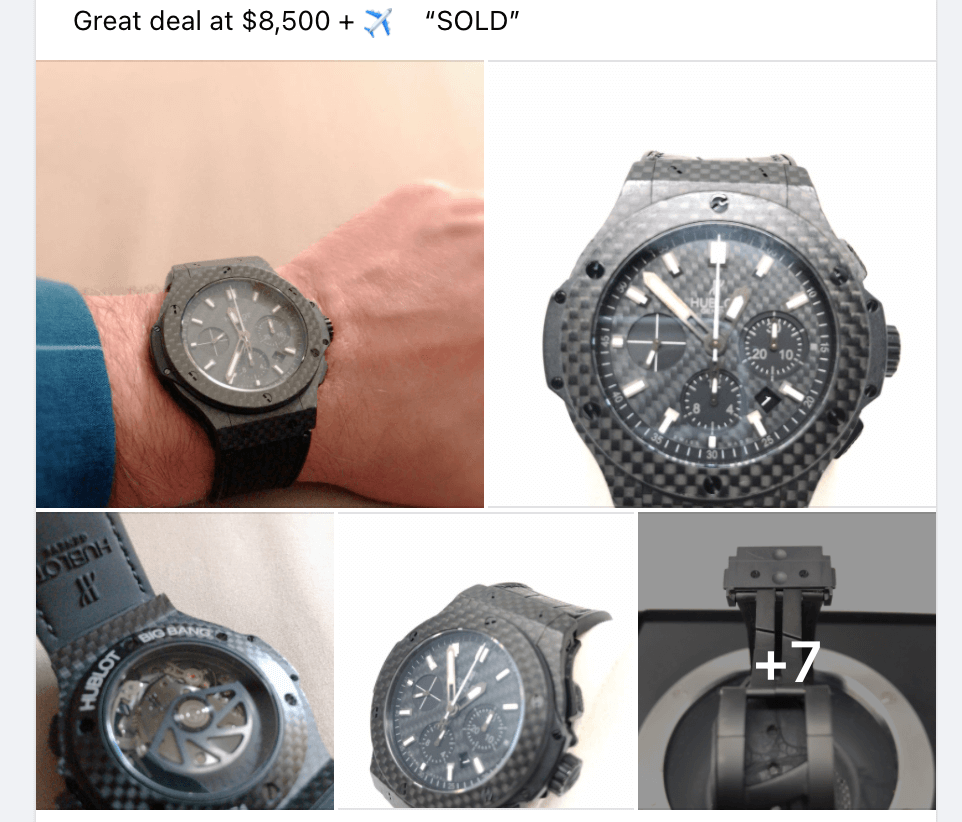

When he starts shopping for watches, he realized (thanks to Watch Trading Academy) that he should never buy a Hublot at retail. Instead of spending $10,300 for a watch worth $5,000, he pays $8,500 for a carbon fiber Hublot Big Bang that was once $21,500.

After year, let’s look at the numbers for Joe Exotic:

Savings: $30,000 (starting savings) – $4,500 (downpayment) – $8,500 (Hublot) = $17,000

Cash in: $1,500* 12 = $18,000

Payments out: $1,003 * 12 = $12,036

Still owed on car: ~$58,000

Value of car if sold: $70,000

Net wealth stored in car: $12,000

Residual value of watch: $9,000

Net Wealth after 12 months: $44,000 (from $30,000)

Difference between Average Joe and Joe Exotic: $17,107

Keep in mind this is also assuming Joe Exotic doesn’t trade a single watch for profit, which, if he was using the rest of his savings to trade part-time, could easily add another $20,000+ in a year.

Plus, Joe can rinse and repeat this process with more cars, using the same dollars over and over to drive whatever he wants.

Let’s say he wants to upgrade to a Lamborghini LP560.

No problem.

His $12,000 in GT-R equity goes with him and continues building in the Lambo.

Here’s what that looks like:

The GT-R sells for $70,000 and he gets $12k returned to him.

Then he buys an LP560 for $125,000 with $15k down and $3k in taxes (using a trade-in tax credit as taught in Exotic Car Hacks, he is exempt from paying the first $70,000).

His monthly payment on a $110k loan is $1,671 at 2.99% for 72 mos.

That’s higher than he’d like, BUT the LP560s are trending up, and in a year he can sell the car for $135,000 with 3k additional miles.

So his $18,000 (down payment & taxes) + $20,052 in payments ($1,671*12 mos) = $38,052 transferred into the asset.

His payoff is just under $93,000 accounting for interest, leaving him with $42,000 in equity.

So AFTER TAXES because he upgraded from a GT-R to a LP560, he’s up $4,000 and that’s before an ~$8,000 tax credit he can use on his next car.

When he upgrades to his Lambo, he also decides he’s tired of the Hublot and want to move into an Audemars Piguet.

So he trades it + $5,000 for a Royal Oak Offshore Rubberclad and after that same year, sells that for $16,000.

Here’s what his money looks like after year 2:

Savings: $35,000 ($17k start of year 1+ 6k year 1 savings, + $12k GT-R) – $18,000 (Lambo) – $5,000 (AP) = $12,000

Cash in: $1,500* 12 = $18,000

Payments out: $1,671 * 12 = $20,052

Loan balance on Lambo: $93,000

Lambo price: $135,000

Equity returned from car sale: $42,000

Value of AP sale: $16,000

Net Wealth after 24 months: $67,948 (from $30,000) WHILE driving awesome cars and wearing cool watches.

In the “Average Joe” example, his net worth at this time from staying in the Lexus and wearing the other Hublot would be less than half of that, at $31,185.

The money doesn’t go away. It transfers and it recycles.

My friends,

This is the difference between how wealthy people think about money and how poor people think about money.

Even people who have some money can still be poor: because all they do is spend their wealth instead of recycle it.

What you need to be doing is transferring your wealth into assets that don’t lose their value.

This way you can still enjoy the luxuries you want in life without the depreciation expenses that come with it.

I obviously use cars and watches but the same can apply to designer bags, sneakers, boats, real estate, etc.

There is a right way and a wrong way to upgrade your lifestyle.

Choose the right way.

Join the community at Exotic Car Hacks today and learn how to keep your money in your portfolio. Plus, enjoy lifetime access to our core training (updated annually) as well as our online community of exotic car owners who are constantly participating in market discussions, high-level networking, and more